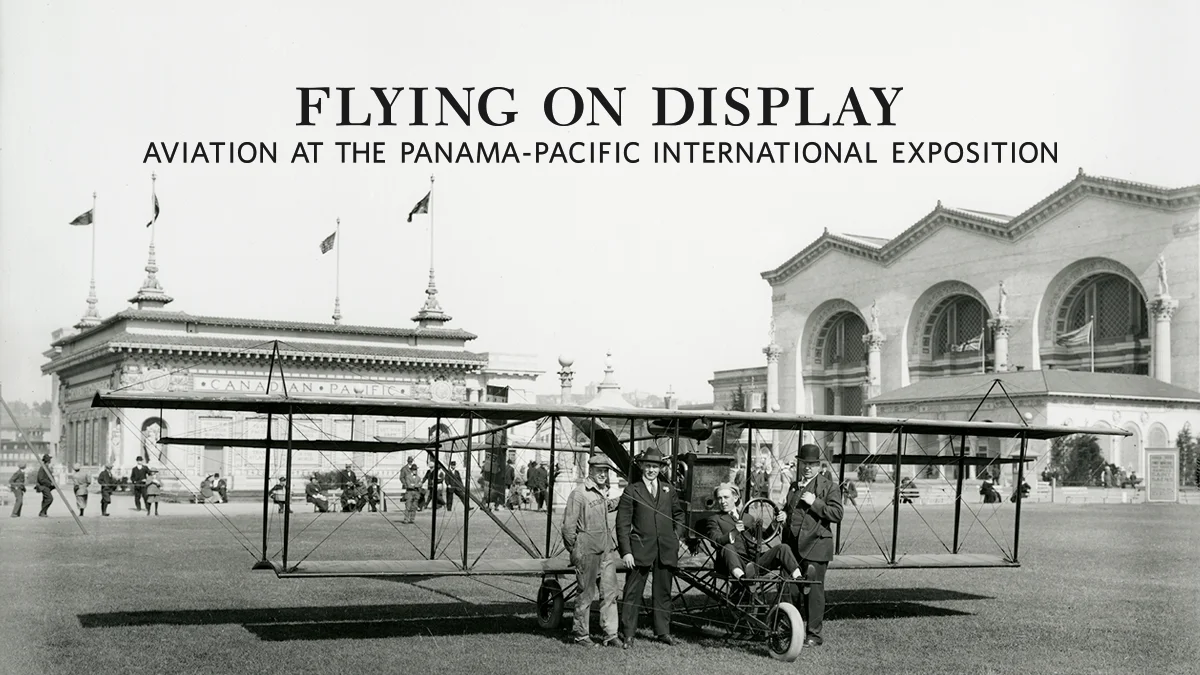

Walk into Harvey Milk Terminal 1, Gallery 1G at SFO and you’re greeted by images that once stopped a world’s fair in its tracks: Lincoln Beachey waving from his monoplane, Charles F. Niles lifting off from the North Gardens, and the Loughead brothers (who later spelled it Lockheed) turning the bay into an aerial playground. The exhibition—“Flying on Display: Aviation at the Panama-Pacific International Exposition”—runs through June 14, 2026, and pulls directly from 1915 glass-plate photographs, giving today’s travelers a front-row seat to aviation’s first blockbuster era.

The PPIE exhibit supplies the spark; the modern training pipeline turns that spark into skills. “Inspiration never goes out of style. Crowds saw Beachey and thought, maybe that could be me. Our work is taking that spark and turning it into safe habits, ratings, and a first cockpit job,” says Mario McGee, founder of Bario Aviation in San Antonio. His school is built as a one-stop shop—flight training, aircraft rental, maintenance, and air tours—so beginners can progress from a discovery flight to their first checkride without losing momentum.

McGee’s favorite historical echo is the Loughead brothers’ 1915 operation—famously offering $10 sightseeing flights that proved aviation could be both thrilling and practical.

“A century ago, the Lougheads turned awe into access. Today, we do the same with structured training, modern avionics, and clear steps from discovery flight to commercial checkride,” he says. The through-line from fairgrounds to flight schools is simple: give people a taste of what’s possible, then give them a path.

What does that path look like in 2025? At Bario’s Kelly Field (KSKF) base in Port San Antonio, students start with focused ground lessons and frequent, efficiently scheduled flights—helped by uncongested airspace—and progress to instrument and multi-engine work in avionics-equipped trainers. The practical setup matters: currency and cockpit time are what move a student from enthusiasm to employability. “That moment you rotate and feel the airplane fly—that’s the hook. We guide students from that first lift-off to real-world proficiency and a career path,” McGee says.

The SFO show makes an ideal peg for telling this broader workforce story because it reminds us how public demonstrations once built the talent pipeline. In 1915, daily flights by marquee pilots didn’t just entertain; they recruited the imagination of the next generation. Today, Boeing’s forecast formalizes what those crowds intuited: aviation thrives when there’s a clear runway from inspiration → instruction → industry. That means accessible discovery flights, competency-based syllabi that compress time-to- proficiency, and schools configured to keep students flying often enough to build skill—and confidence.

As McGee puts it: “Aviation has always grown on inspiration. Exhibits like this supply it; schools like ours convert it into skill.”

Exhibit details: “Flying on Display: Aviation at the Panama-Pacific International Exposition,” Harvey Milk Terminal 1, Departures Level 2, Gallery 1G, June 17, 2024 – June 14, 2026.

From 1915 Air Thrills to 2025 Careers: SFO’s “Flying on Display” Meets a Hiring Boom